Under the new rules, the FCA demands that firms marketing some types of high-risk investments will need to conduct better checks to ensure consumers and their investments are well matched.

Firms also need to use clearer and more prominent risk warnings and certain incentives to invest, such as “refer a friend bonuses”, are now banned.

As part of its Consumer Investments Strategy, the FCA wants to reduce the number of people who are investing in high-risk products that do not reflect their risk appetite.

This follows concerns that a significant number of people who invest in high-risk products do not view losing money as a danger of investing and invest without understanding the liabilities involved.

These new rules build upon what the FCA insists is a “more assertive and interventionist approach” to tackling poor financial promotions, reducing the potential for unexpected consumer losses.

In the past year alone, the regulator has intervened in significantly more financial ads to prevent harm. In the year to the end of July 2022, 4,226 ads were amended or withdrawn after FCA action.

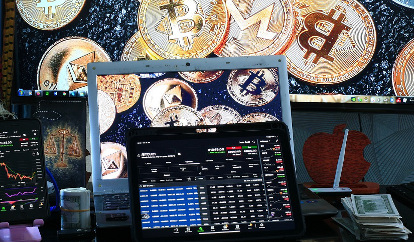

Even so, the new rules will not apply to cryptoasset promotions, arguably the most controversial financial products. An estimated $2trillion has been wiped from the total industry market cap since the beginning of 2022.

However, the FCA says its hands are tied until the Government – and Parliament – confirms in legislation how crypto marketing will be brought into the FCA’s remit.

The regulator says these rules are likely to follow the same approach as those for other high-risk investments, insisting that crypto remains high risk so people need to be prepared to lose all their money if they choose to invest in cryptoassets.

FCA executive director of markets Sarah Pritchard said: “We want people to be able to invest with confidence, understand the risks involved, and get the investments that are right for them which reflect their appetite for risk.

“Our new simplified risk warnings are designed to help consumers better understand the risks, albeit firms have a significant role to play too. Where we see products being marketed that don’t contain the right risk warnings or are unclear, unfair or misleading, we will act.

“This is even more important now because increases in the cost of living could prompt people to chase higher investment returns which may prove risky.”

Late last year, the Advertising Standards Authority reported that ads for cryptoassets were a “red alert” priority issue. Following a series of ASA rulings, in March it published an enforcement notice about the advertising of cryptocurrencies, including guidance for advertisers.

When promoting cryptocurrencies, crypto exchanges or promotions that otherwise involve the transfer, sale or supply of cryptocurrencies, advertisers must make it expressly clear in the ad that cryptocurrencies are unregulated in the UK; cryptocurrency profits may be subject to Capital Gains Tax; and the value of investments is variable and can go down as well as up.

The ASA warned that advertisers should immediately review the guidance and make any changes required, adding that the compliance team would take targeted enforcement action from May 2022, which may include the application of sanctions. However, to date, the watchdog has yet to take any enforcement action under the new rules.

Related stories

ASA ‘red alert’ crackdown rips down cryptocurrency ads

Tech giants too slow to act as scammers ‘run riot’ online

Lewis and Facebook bury the hatchet over fake ad case

Martin Lewis sues Facebook over ‘fake’ finance ads

Finance ads ripped down as Martin Lewis goes ballistic

Cryptocurrency ads get the chop in Google clampdown